Long-Term Perspective: Market Volatility is the Price of Admission for Investing

The stock market had a strong start this year. The S&P 500 gained over +15% in the first six months, its 16th strongest first-half return since 1931. The equity market’s rise continued into early July, and the index set a new all-time closing high on July 16th. However, the stock market experienced increased volatility as it traded lower over the past few weeks. The selloff accelerated in the first week of August after a report showed unemployment rose to 4.3% in July, a nearly 3-year high. The recent volatility has been a notable change from the first half’s steady climb, with the S&P 500 at one point -8% below its all-time high from mid-July.

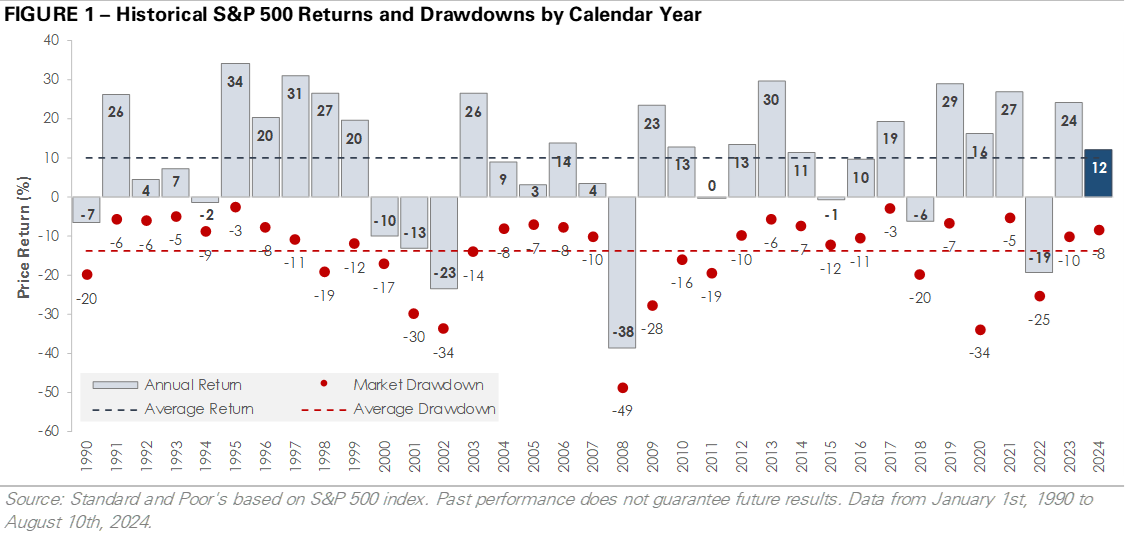

History shows that stock market drawdowns are a natural part of investing. The chart below graphs the S&P 500’s price return each year since 1990. The navy line shows the index has produced an average annual return of nearly +10%, but the bottom half of the graph shows a lot can happen within the market throughout the year. The red dots show the S&P 500’s biggest intra-year decline in each year. Since 1990, 32 of 35 years have had an intra-year selloff of -5% or more. Nineteen years have had a selloff of -10% or more, with six years seeing a drawdown greater than -20%.

Stock market volatility is the price of admission for investing. In the short term, markets move in both directions as data changes and investors adjust to new information. In the long term, corporate earnings and economic growth influence the market. The recent market volatility appears inconsistent with recent earnings and economic data. With over 90% of companies reporting, S&P 500 earnings grew more than +10% year-over-year in the second quarter. Wall Street analysts expect an additional +10% earnings growth over the next 12 months. Unemployment is rising but remains low by historical standards. Consumer sentiment is improving as inflation eases, and retail spending continues to grow. The chart below puts the recent volatility into perspective, and the market’s quick bounce back is a timely reminder of why we invest with a long-term mindset.