Investing Based on Politics is a Bad Idea for Your Retirement Portfolio

As the 2024 presidential election approaches, Americans are preparing to vote in what polls forecast to be a tight race. Like many investors, you may wonder how the election outcome could affect financial markets and whether you should change your investment strategy. While elected leaders can influence economic growth by enacting laws and regulations, data suggests that who occupies the White House has little to no impact on investment performance. Fundamental factors like corporate earnings growth and valuations impact the stock market far more than political headlines. Politicians make many promises during election years, but these often go unfulfilled because of the government’s system of checks and balances. Moreover, the economic outcomes of policies are less predictable than officials think, with the economy more influenced by factors like job growth, interest rates, and inflation.

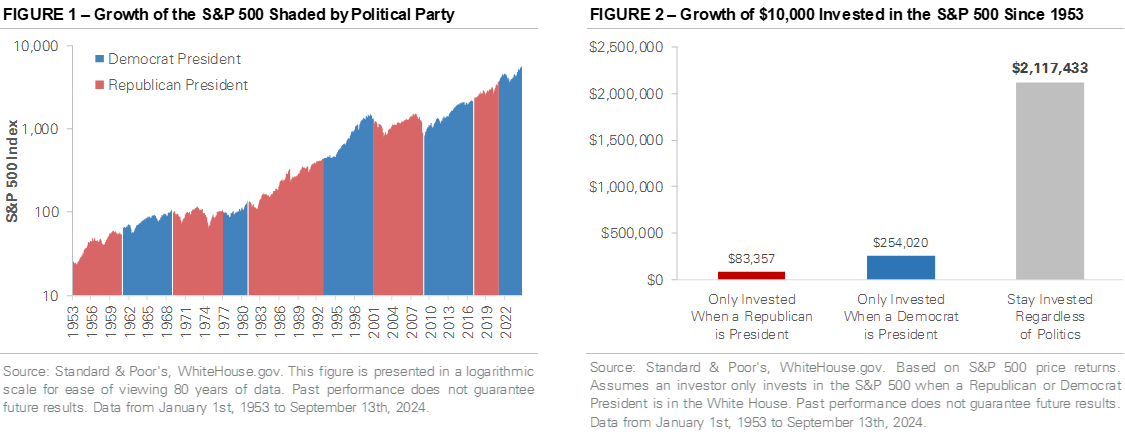

The charts below illustrate the financial impact of allowing political beliefs to influence investment decisions. The chart on the left graphs the S&P 500 Index starting with Dwight Eisenhower’s presidency in 1953 and is color-coded by political party. The graph on the right compares the investment performance of portfolio decisions made based on political affiliation. If an investor only invested in the stock market when a Republican was President, $10,000 would have grown into $83k today, excluding dividends. Investing only when a Democrat was President would have returned $254k. While the gap may seem wide, if an investor ignored the president’s political party and remained invested, the $10,000 would have grown to over $2.1 million.

Political views can stir strong emotions, but making investment choices based on those feelings can lead to poor portfolio decisions. Instead, it’s better to focus on time-tested investment principles and avoid letting politics influence your long-term strategy. The U.S. economy’s success, growth, and resiliency don’t change with each new election, and neither should your investment strategy. It’s best to express political opinions at the ballot box, not in your portfolio.

Past performance does not guarantee or indicate future results. Any index performance mentioned is for illustrative purposes only and does not reflect any management fees, transaction costs, or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Index performance does not represent the actual performance that would be achieved by investing in a fund.