How Nvidia Is Shaping the S&P 500’s Performance in 2024

The S&P 500 Index is a well-known stock market index that tracks the performance of 500 of the largest U.S. companies. Many large-cap ETFs passively track the broad index, and investors use it as a benchmark to gauge the relative performance of their portfolios. This year, a unique phenomenon is impacting the S&P 500. A single stock has contributed over one-third of the S&P 500’s total return, which means its inclusion or exclusion in different market indices has made a big difference.

Nvidia, a leading semiconductor company in the artificial intelligence (AI) industry, is rapidly growing. Companies like Microsoft, Amazon, Google, and Facebook-parent Meta are spending billions on Nvidia’s computer chips to train their AI models. The company's strong earnings growth has caught investors' attention. The stock has gained almost +170% year-to-date and recently surpassed Apple as the second biggest S&P 500 holding. Due to its high index weight and strong return, Nvidia has contributed 33% of the S&P 500 Index’s year-to-date return.

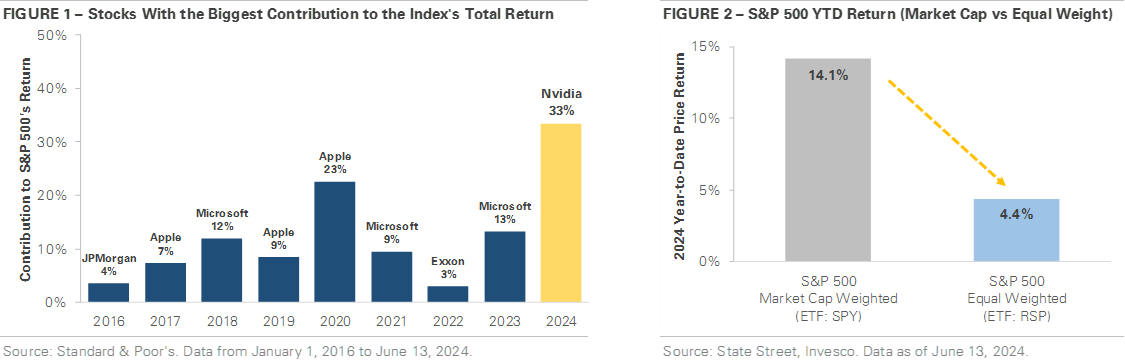

How often does one company account for such a large portion of the index’s return? The answer is rarely. The bars in Figure 1 show the S&P 500 company that contributed the most to the index’s return by year. Between 2016 and 2023, the stock with the most impact contributed an average of one tenth of the S&P 500’s return. The biggest previous contribution occurred in 2020, when Apple contributed 23%.

Our team wanted to share this market statistic for two reasons. First, it is rare for one stock to account for a significant portion of the S&P 500’s return. This market is one for the history books. Second, Nvidia’s dominance has implications for portfolio analysis. Figure 2 shows how the S&P 500 would have performed if its holdings were weighted equally rather than by market capitalization. The market-cap weighted S&P 500 Index has gained +14.1% as of June 13th, while the equal-weighted version of the S&P 500 has only gained +4.4%. This year's performance shows that the headline return can overstate the average company’s performance, but this isn't always the case. Between 2000 and 2023, the equal-weighted S&P 500 outperformed its market-cap weighted peer 15 out of 24 years. It's important to look beyond the headline market return when analyzing portfolio performance.