Market History: Can the S&P 500 Maintain Its 2024 Momentum?

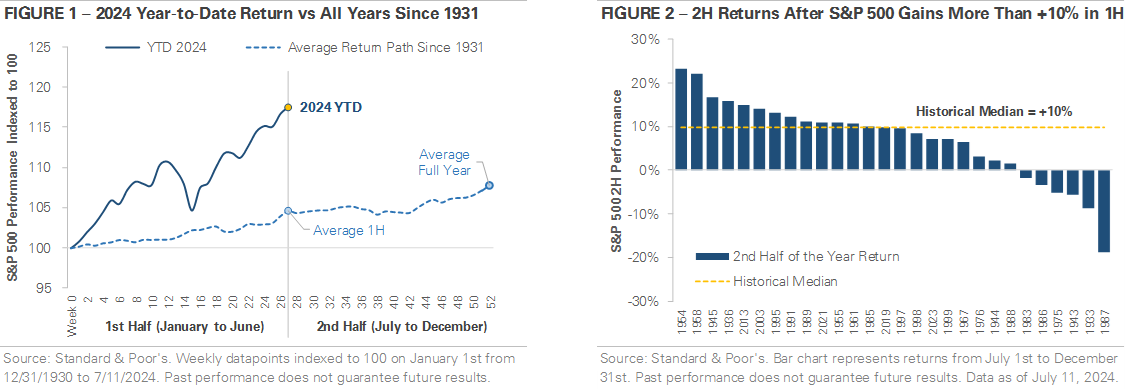

The stock market had a strong start in the first half of 2024. Figure 1 compares the S&P 500’s year-to-date return against its average annual return path since 1931. It shows returns for the first half of the year were above average, with the S&P 500 already surpassing its average full-year return. In Q1, the S&P 500 set 22 new all-time highs after not setting a new high since January 2022. There was a -5% sell-off in April, but the S&P 500 recovered by mid-May and set new highs in late Q2. By the end of June, the S&P 500’s +15% return ranked as the 16th strongest first-half return since 1931. It was also more than 7% above the average full-year return, despite only being at the mid-year mark.

A logical question to ask is whether the stock market can continue to trade higher. Figure 2 graphs the S&P 500’s second-half return in years when it gained +10% or more in the first half. The chart ranks those 28 years by second half return rather than chronological order. The S&P 500’s median second-half return was +10%, and it traded higher almost 80% of the time. In 13 of those 28 years, it gained more than +10% in the second half. The largest loss was in 1987 when the S&P 500 returned -19% after the Black Monday crash. Otherwise, only three other years produced a second-half loss of more than -5%: 1933 (-8.6%), 1943 (-5.5%), and 1975 (-5.3%).

History suggests that the stock market has the potential to trade higher in the second half of 2024. One reason may be human behavior. Investors often think in terms of calendar years, which can influence their actions. For instance, after a strong first half, investors may feel compelled to chase the market in the second half. No investor wants to underperform when the market is rallying. Investors may also be reluctant to sell after a strong first half to avoid capturing short-term capital gains and paying a higher tax rate. Regardless of the reason, there is a historical tendency for first-half gains to continue into the second half.

The calendar for the remainder of 2024 is full of market-moving events, from the first potential interest rate cut to the U.S. presidential election later this fall. We will be monitoring these events and incoming economic data for any shifts in the market narrative. However, a quick look at history suggests markets could continue to trade higher in 2H 2024.

The information and opinions provided herein are provided as general market commentary only and are subject to change at any time without notice. This commentary may contain forward-looking statements that are subject to various risks and uncertainties. None of the events or outcomes mentioned here may come to pass, and actual results may differ materially from those expressed or implied in these statements. No mention of a particular security, index, or other instrument in this report constitutes a recommendation to buy, sell, or hold that or any other security, nor does it constitute an opinion on the suitability of any security or index. The report is strictly an informational publication and has been prepared without regard to the particular investments and circumstances of the recipient.

Past performance does not guarantee or indicate future results. Any index performance mentioned is for illustrative purposes only and does not reflect any management fees, transaction costs, or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Index performance does not represent the actual performance that would be achieved by investing in a fund.